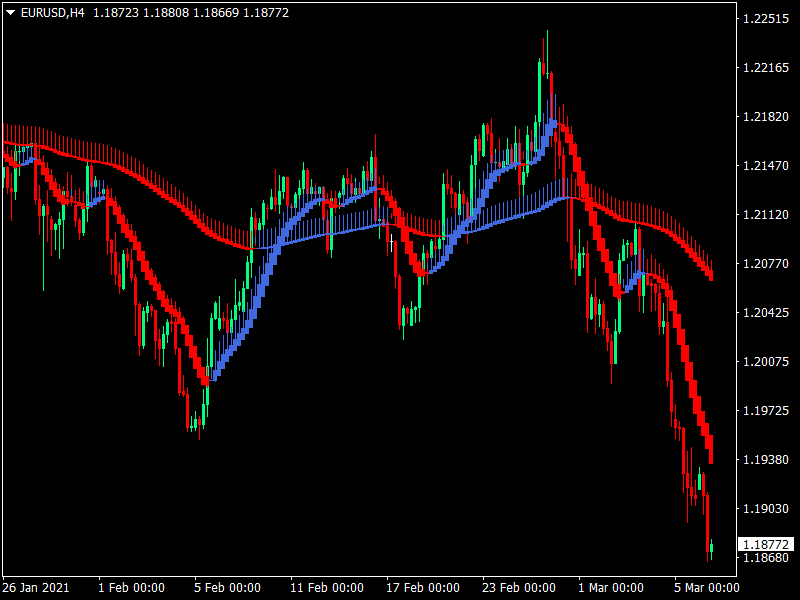

Dual Heiken Ashi Forex Trading Strategy is based on two different valued Heiken Ashi indicators to sort out profitable trading positions. In other words, this method is based on a low noise indicator like smoothed Heiken Ashi.

It is a low noise technical indicator, even with the standard parameters. The Heiken Ashi indicator usually changes bar color when the asset price changes the trend.

Therefore, it occurs after making every valid higher high and low with the price movement. This strategy is suitable for any (major or cross) currency pair, and the recommended time frame is a 1-hour or 4-hour chart.

Unlike the regular Japanese candlesticks, the Heiken Ashi candlesticks filter out the noise differently and more clearly. These candlesticks can highlight the trend of the market more quickly than other methods by their appearance.

Intense buying pressure might not have lower shadows (wicks), and Strong selling pressure will generally not have an upper shadow. Check the lower wicks on up HA candles and upper wicks on down HA candles to identify the weakening trend.

The idea of trading by this strategy is straightforward. You can get the entry points by the fast Heiken Ashi indicator. It changes its bars’ color before the slow Heiken Ashi by the market data and parameter value.

The slow Heiken Ashi was used to confirm the price direction and the validity of the trend. When both Heiken Ashi indicator bars are blue, the asset price remains at an uptrend, and for continuous downtrend price movement, both Heiken Ashi bars become red.

It is a 1:2 risk ratio strategy; enter buy orders when it’s complete buy pressure confirmed by the trading tools. You can exit (take profit) or shift the stop loss position at or above the position after the first higher high made by the price movement and vice versa.

Download Now

Related Free Mt4 Indicators

Dual MACD Forex Trading Strategy

HMA Dot Crossover Forex Trading Strategy

Don't Miss Pro Indicators