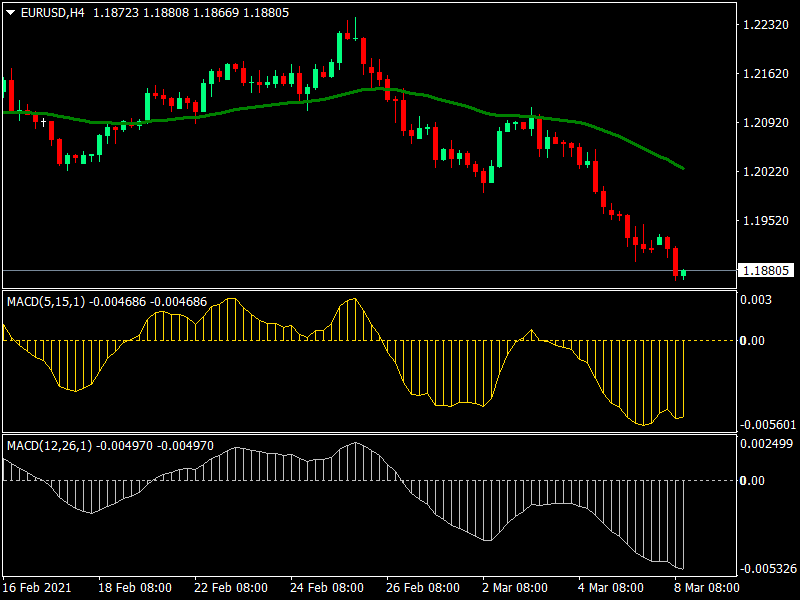

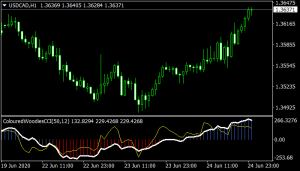

Dual MACD Forex Trading Strategy has two different values Moving average convergence divergence (MACD) with histograms below the main chart. Moreover, it uses a Moving Average to generate profitable trading ideas or positions.

This strategy is suitable for any kind of (cross or major) forex currency pair except large spread at the time frames or 1-hour or higher. The 1-hour chart is preferable when one of the currencies markets is open (EX: USD/JPY- Asia or New York Session).

If you want to ignore the trading session, you can use the charts of 4-hours or higher.

The idea behind the use of dual MACD is simple. Here the faster MACD generates the trade idea, and the slower MACD confirms the price direction. Investors can use this system to take entry at the retracement levels, as the faster MACD is sensitive enough to provide signals during the retracement.

We can quickly identify the overbought and oversold conditions at the asset price by an oscillator indicator like MACD. In MACD, the bar size gets changed with the volatility at the asset price.

The bars above the middle (0) line of the MACD window indicate that the price is at an uptrend, and the bars below confirm the downtrend.

Another common and popular technical tool is the Moving Average (EMA 50) in this trading method. The price candles above the Moving Average (EMA 50) line and the direction of this signal line toward upside indicate that the asset price is bullish and vice versa.

This strategy is straightforward, place buy orders when both the MACD windows and the EMA line confirms the price direction is upward. Similarly, check and match all three indicators reading matches and suggest downtrend price movement before placing sell orders.

Download Now

Related Free Mt4 Indicators

HMA Dot Crossover Forex Trading Strategy

Don't Miss Pro Indicators