Kiss Forex Trading Strategy is based on some most common technical tools/indicators. This trading method uses price action, LWMA (linearly weighted moving average), and MACD histogram.

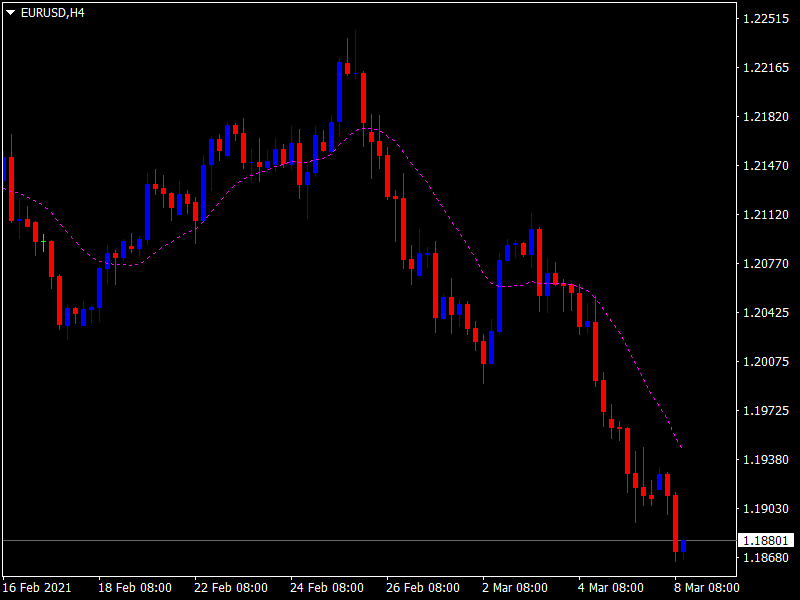

As a profitable trading strategy, this method is suitable for any major or cross currency pair. Moreover, it is applicable on any time frame from 4-hour or above, but the most reliable time frame for this method is the 4-hour chart.

So it’s not a scalping strategy, few best setup can get weekly for a specific currency pair.

Parameters used in this strategy:

- 4-hours chart

- The linearly weighted moving average value is 20 (LWMA 20)

- MACD histogram uses standard-setting with the value of MACD(24,52,18).

Follow the trend as the price action suggests. The higher highs and higher lows are scenarios of an uptrend, while lower lows and lower highs are created at the downtrend price movement.

Match the trend with the higher time frames charts if both are the same, then it’s the best setup to enter the market. Additionally, the price action traders just look for engulfing, pinbar, tweezers patterns, etc., at the price shifting points.

The best option to take the trade is when these patterns are seen at the major support-resistance or historical levels.

After the price action setup is confirmed, check the LWMA (20) signal line direction is as same as the price action suggests. Then match both readings with the MACD histogram indicator window.

At the MACD histogram window, when the bars are above the middle (0) line, it’s a declaration of an uptrend price movement, and the bars below the middle line are created for a downtrend.

Big bars (above or below) at this indicator window mean high volatility and when the volatility reduces the bars get shorter.

As this is a trend following strategy, shift stop loss at or above or below the entry point after price makes the first higher highs or lower lows is suggested to reduce risk.

Download Now

Related Free Mt4 Indicators

Don't Miss Pro Indicators