“Wolfe Waves are a fight towards an equilibrium price and one of the most reliable predictive reversal patterns….”

— Bill Wolfe

This “Wolfe Wave Dashboard” Indicator Scans ALL Currency Pairs & ALL Time-Frames For Wolfe Wave Patterns – The Most Reliable Predictive Reversal Pattern IMHO…

Reversal patterns suck.

I mean… Does this sounds familiar?

You identified a reversal pattern. You’ve heard that this is a high-probability pattern. So you placed a trade against the current trend and set your stop loss.

Then, almost as soon as you placed your trade, the market resumed its original trend.

How many times did this happen to you? Honestly I lost count.

Sometimes it feels like the market is playing a joke on me.

That’s why I went on a quest to find the single most reliable reversal pattern out there.

And not only that, I wanted to code an easy-to-use indicator that automatically detects this pattern, so I don’t have to lift a finger.

I’d love to think that I’ve found it.

Here’s why:

There’s a natural pattern that occurs in every market and on every time-frame. It’s called Wolfe Wave. And the interesting part about this pattern is that…

The shape of a Wolfe Wave pattern shows a fight for balance, between supply and demand…

And this is particularly important because…

When the pattern is completed, that means the fight for balance has ended. And you’d know which side has won: Supply or Demand, Bulls or Bears.

In other words, you’d immediately know (with high probability) which direction the market is heading.

So you could be sure whether a trend reversal will happen or the original trend will continue.

No more fear. Now you could trade with confidence.

Peace of mind. That’s probably what most traders (me included) are craving.

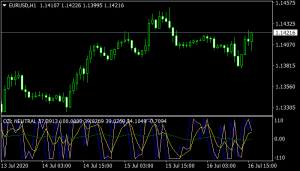

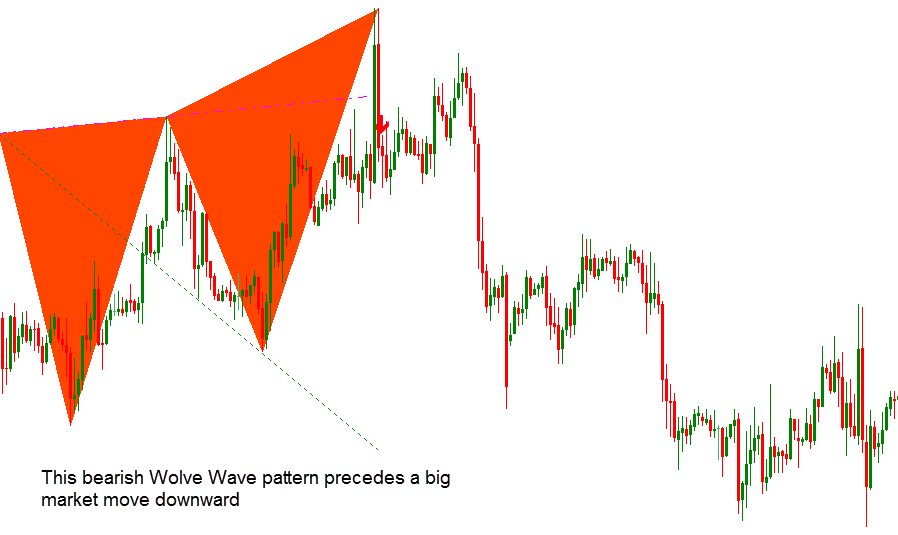

But enough theory. Let’s take a look at Wolfe Wave patterns in action. Here are 2 consecutive Wolve Wave patterns (one bearish and one bullish) that occured on EUR/USD 1-hour timeframe.

Look at this:

And this:

As you can see, Wolfe Wave patterns flat-out works. In this example, the bearish Wolfe Wave pattern is followed by a significant market move to the downside, while the bullish Wolfe Wave pattern marks the beginning of a new uptrend, providing plenty of opportunities to cash in.

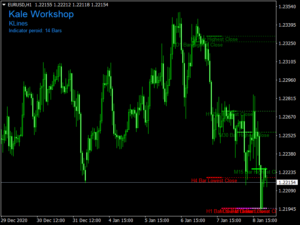

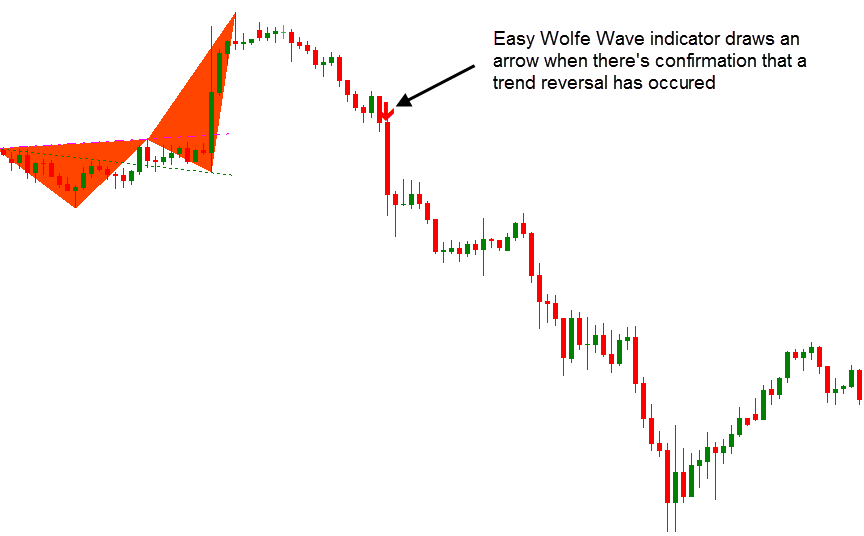

Now that you’ve see the power of this amazing reversal pattern, meet our Easy Wolfe Wave indicator:

This “Easy Wolfe Wave” indicator automatically detects every single valid Wolfe Wave pattern on every time-frame, every currency pair…

The indicator does all the hard work, so you don’t have to.

Let’s take a look at how the indicator works:

First, the Easy Wolfe Wave indicator automatically identifies any Wolfe Wave pattern for you, as soon as it’s completed. And it works on every time-frame, every currency pair, every financial instrument for that matter.

When a Wolfe Wave pattern has formed, it means that a trend reversal is likely to happen. So we’d wait for a confirmation that the trend has indeed changed.

And when we’ve got that confirmation, the Easy Wolfe Wave will draw an up/down arrow on your chart, telling you there’s a trade opportunity for you to consider. In addition, the indicator also gives you audio and pop-up alerts.

And here’s where it gets even better:

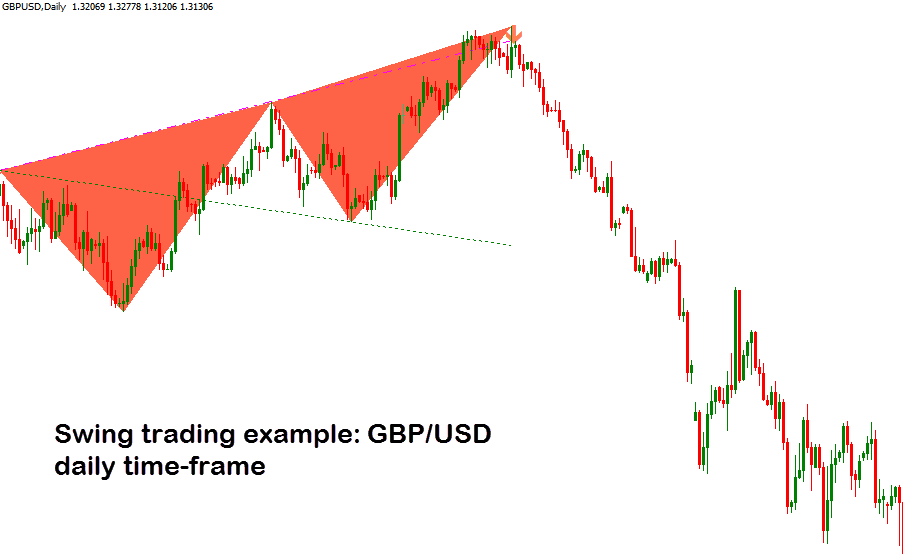

The “Easy Wolfe Wave” indicator works equally well for BOTH day trading and swing trading…

For example, look at this swing-trading chart on GBP/USD daily time-frame:

In fact, this bearish Wolfe Wave pattern leads to a gigantic downtrend that’s still going on as of the time I’m writing this. What’s amazing is that if I just entered when this pattern was confirmed, I’d have pocketed 3,934 pips so far. How’s about that?

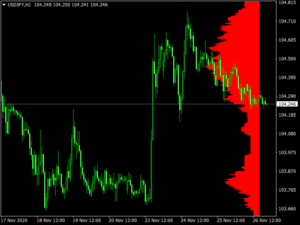

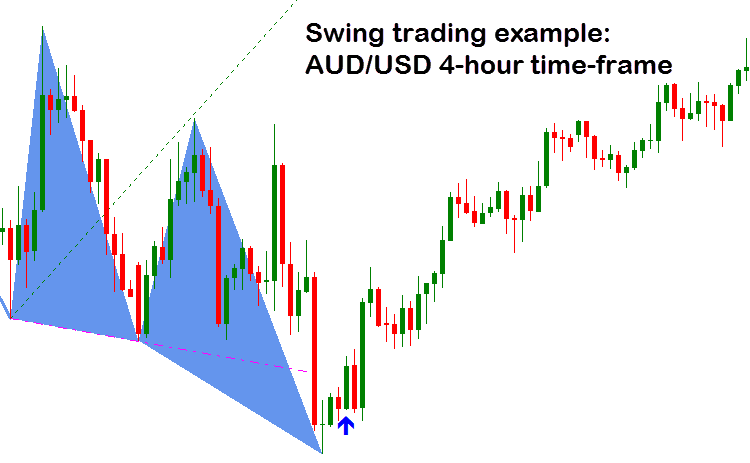

Here’s another swing trading example on AUD/USD 4-hour time-frame:

As you can see, the Easy Wolfe Wave indicator works extremely well on swing trading (on larger time-frame like 4-hour or daily). And if you asked me, I’d say this is my #1 pattern when it comes to identifying trend reversals on larger time-frames.

Now let’s look at a few day trading example. First, EUR/JPY hourly time-frame:

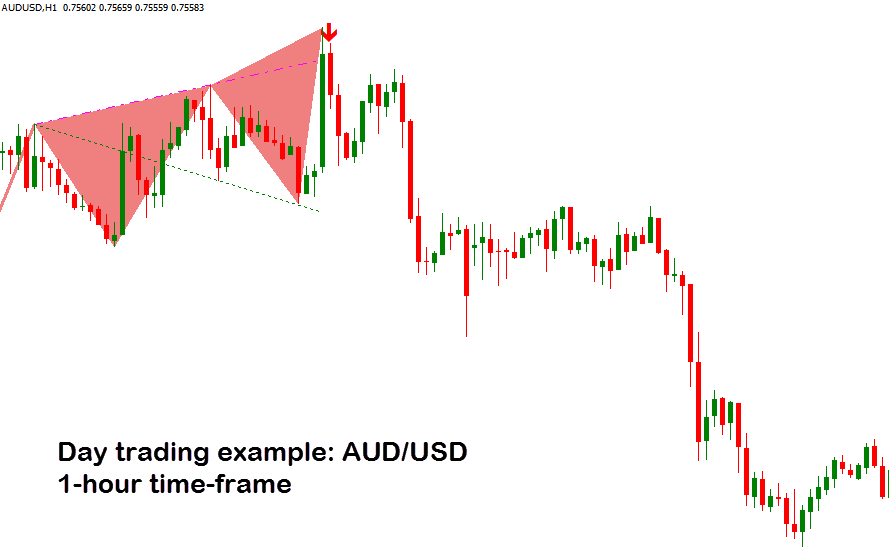

Second, AUD/USD hourly time-frame:

Download Now

Related Free MetaTrader 4 Indicators

Don't Miss Pro Indicators