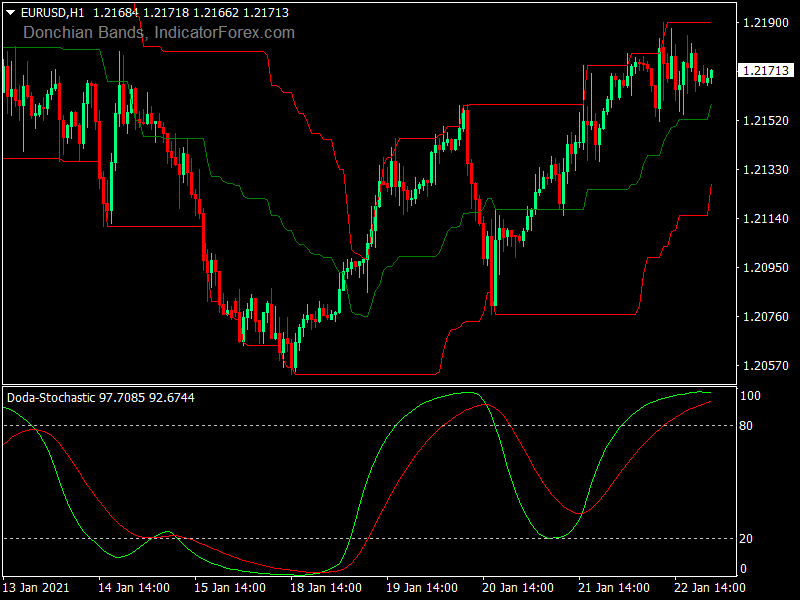

Doda Stochastic Forex Trading Strategy is based on two Custom made trend following indicators named Donchian Bands and Doda-Stochastic.

Where Donchian Bands are a modified version of the well-known indicator Bollinger Bands that works on every cross or major currency pairs, stocks, or commodity index.

When price touches or remains at the upper band, it indicates the asset price is at the overbought condition and price candles at the lower band indicate an oversold condition at the asset price.

The Doda-Stochastic works in the same way as the traditional stochastic does in an independent window that contains two signal lines and two (20 and 80) levels.

When the market turns bullish the green signal crosses above the red line and heading towards the upper (80) line and for a bearish movement the green signal line crosses below the red line and heading towards the lower (20) line.

The signal line at or above the upper (80) line indicates an overbought asset price and vice versa.

The trading strategy simply allows the traders to catch the probable reversal price shifting or identifies the higher highs and lower lows for a certain period of time.

The Doda Stochastic can be leveled as an initial filter for this strategy. This strategy suggests entering the market in extreme conditions.

When the market is at the oversold condition or the signal lines below the lower (20) level at the Doda Stochastic indicator window, wait until the Doda Stochastic signal lines crossover (green line crosses above the red line)

happens and place a buy order and above the upper (80) line or from overbought condition wait until the crossover (green line crosses below the red line) happens and enter for sell order.

Note: Multi-timeframe analysis is suggested as the stochastic indicator only focuses on momentum while ignoring many other facts about market movement.

Download Now

Related Free Mt4 Indicators

Big Trend Scalping Trading Strategy

Don't Miss Pro Indicators